Federal Retirement Gap Report

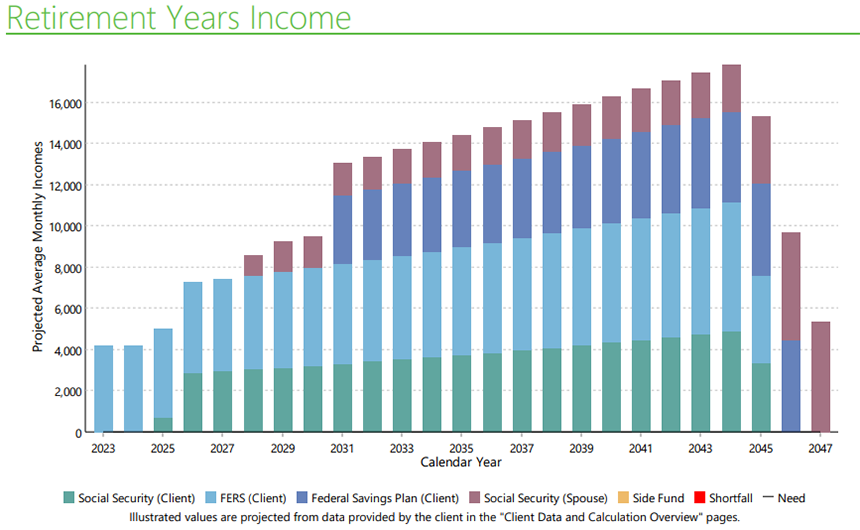

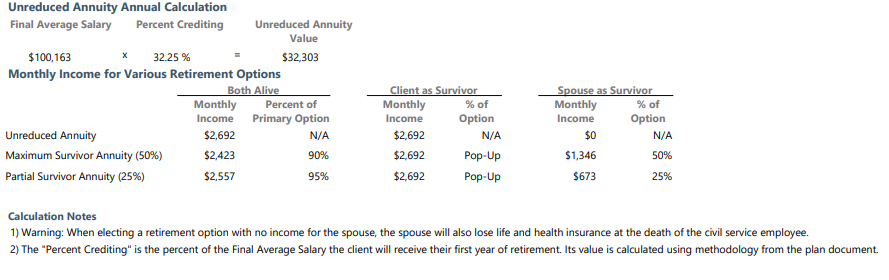

As a member of our site you are eligible for a free Gap Analysis report. A Gap Analysis is the first step for retirement planning as a Federal Employee. The report will help determine your FERS or CSRS pension, income expected from Social Security and the probability of running our of your retirement savings. The Gap Analysis can also project future cost of your federal insurance post retirement and much more. This is the first and most important step for retirement planning to identify future problems and solve them today.

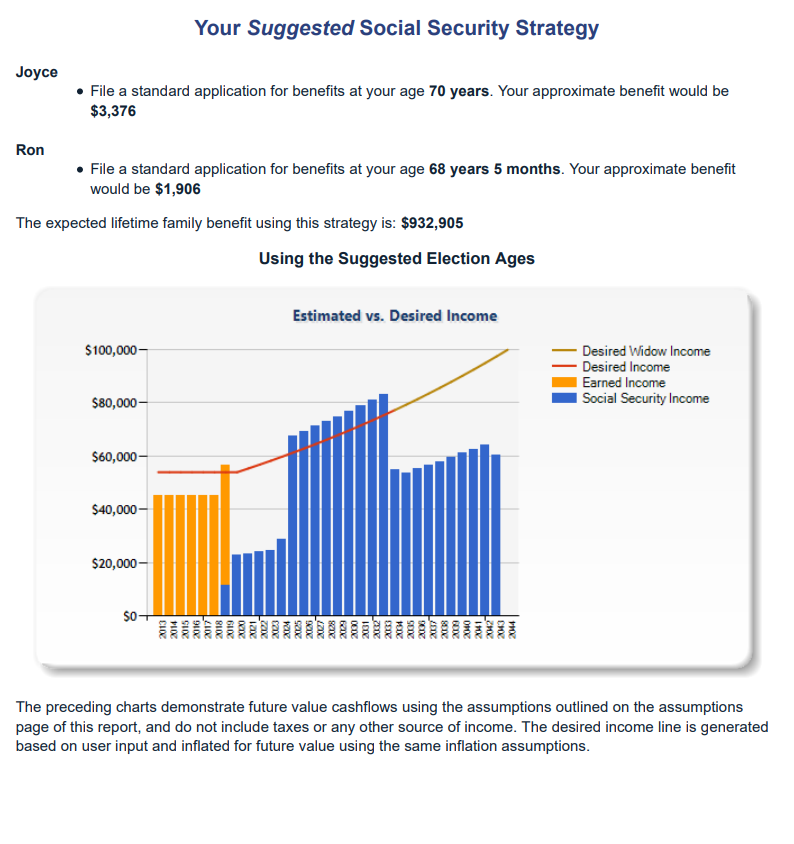

Social Security Timing Reports

In the 1930s, when Social Security was signed into law, it was a pretty straightforward process for eligible retirees.

There wasn’t a difficult decision about when to file for benefits. You had to be 65 to claim your benefits — there was no early retirement age. And delaying past 65 didn’t get you extra — so it really wasn’t worth waiting.

Today, it’s far tougher to pin down exactly when you should file — even if you only consider age (which you shouldn’t). You can take your benefits as early as 62 — though the earlier you claim, the less you’ll get — or as late as age 70 (with the incentive that you’ll get 8% more for each year you wait past your full retirement age).

With a Social Security timing report we can help you pick the exact day and month you should start receiving your benefits. Sign up today to begin your journey to financial peace during retirement.

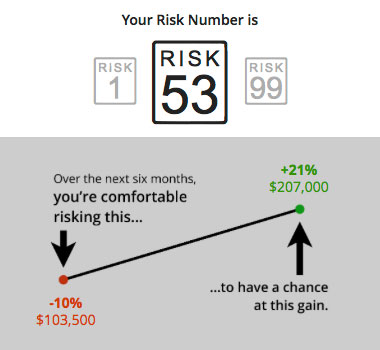

Risk Analyzer

Do you know exactly what fees you are paying with your investments? Does your financial statement show the hidden fees charged by most managers and mutual funds? Did you know some mutual funds’ internal expenses can exceed 2.5%? If you are uncertain, sign up for our Risk Analyzer today. Feed can have a large impact over time and seriously reduce the amount of retirement savings you will have to live on during nonworking years.

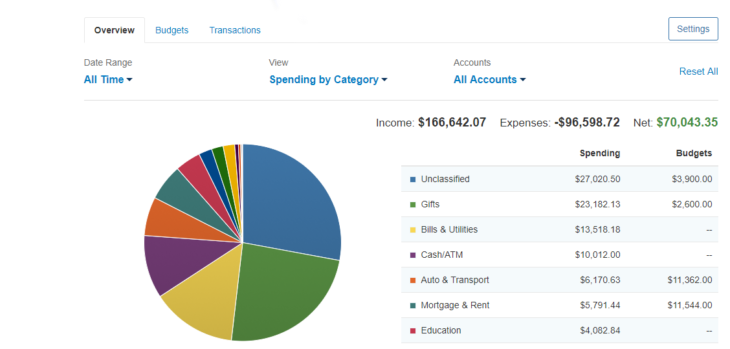

Budgeting & Spending Tracker

Simplify your budgeting and spending with our custom tracker. It is important to know where your hard earned money is going and with our tracker you can pinpoint your expenses and make adjustments that will save money. We can help you set a budget and decide what items to reduce in order to help meet your financial goals.

Retirement Planning

One of the biggest problems Americans are facing today is outliving their retirement savings. Another major issue is not being properly insured for the “what ifs” in life. Tax planning is also a major issue when it comes to financial planning. We can help cover all aspects of financial planning. The importance of a full financial plan can not be stressed enough. It is never too late to build a solid financial plan. Start yours today.